13 Wake Forest L. Rev. Online 1

Mark T. Wilhelm[*] & Michael T. Byrne[**]

Publicly traded companies in the United States are required to disclose a significant amount of information to the public in order to comply with applicable securities laws.[1] While at times those disclosure requirements are rather rigid, there are many circumstances in which these companies retain latitude to keep secrets out of the public eye—and notably, out of the reach of their competitors.

Public companies are required to file disclosure documents with the U.S. Securities and Exchange Commission (“SEC”), which are made available to the public pursuant to the Freedom of Information Act (“FOIA”).[2] In particular, Item 601(b)(10) of Regulation S-K requires public companies to file as an exhibit to their disclosure documents copies of certain material contracts into which the company has entered.[3] These exhibits often include sensitive information that companies prefer to keep confidential for competitive or other reasons.

Accordingly, under Rule 406 of the Securities Act of 1933[4] and Rule 24b-2 of the Securities Exchange Act of 1934,[5] the SEC permits public companies to request confidential treatment of certain information contained in these exhibits—meaning a company may redact the sensitive information and shield it from public view. FOIA permits the SEC to grant such requests if the redacted information falls into one of FOIA’s specified exemptions. The most commonly cited FOIA exemption in this context is found in Section 552(b)(4), which protects “trade secrets and commercial or financial information obtained from a person and privileged or confidential.”[6]

Historically, at the time that public companies redacted information from these exhibits, they were required to submit along with the exhibit a formal, hard copy confidential treatment request (“CTR”) with the SEC.[7] Submitting a CTR was a relatively arduous process that involved preparing and mailing a particularly formatted application to the SEC that specified (i) the justifications for redacting each piece of information, (ii) which FOIA exemption applied to each piece of information, and (iii) other pertinent details. The CTR also needed to include an unredacted copy of the exhibit that was the subject of the request. Upon receipt of a CTR, the SEC issued a confidential treatment order (“CT Order”) either granting or denying the CTR.[8] If denied, the company had to publicly refile the exhibit without the proposed redactions.

On March 20, 2019, the SEC announced it had modernized and simplified its rules related to, among other things, confidential treatment of information in filed exhibits.[9] The changes, which went into effect in May 2019, were aimed at bringing the SEC’s disclosure requirements into compliance with the Fixing America’s Surface Transportation Act (“FAST Act”).[10] Initially, following the rule changes, a public company could forgo submitting a formal CTR application if the redacted information was not material and would be competitively harmful if publicly disclosed.[11] However, on November 2, 2020, the SEC adopted amendments to eliminate the competitive harm requirement of CTRs in response to the Supreme Court’s clarification of the definition of “confidential” in Food Marketing Institute v. Argus Leader Media,[12] which stated: “[a]t least where commercial or financial information is both customarily and actually treated as private by its owner and provided to the government under an assurance of privacy, the information is ‘confidential’ within the meaning of [FOIA Section 552(b)(4)].”[13]

Thus, currently, if a public company redacts portions of a filed exhibit without submitting a formal CTR, the company must:

(i) mark the exhibit index to indicate that portions of the exhibit or exhibits have been redacted;

(ii) include a prominent statement on the first page of the redacted exhibit that certain information has been excluded from the exhibit because it is both (1) not material and (2) the type that the company treats as private or confidential; and

(iii) include brackets indicating where the information has been redacted from the filed version of the exhibit.[14]

Notably, public companies retain the option to submit formal CTRs to the SEC, and even after the rule changes, a very limited number of public companies have continued to do so.[15] This continued practice is likely a result of such companies (i) simply being unaware of the rule changes, (ii) failing to adjust their practices to conform with the new, relaxed rules, or (iii) taking what could be aggressive positions on what information is confidential, and proactively seeking SEC guidance on whether such confidential treatment would be granted.

As part of the same rule changes, the SEC also reduced the quantity of materials that public companies must file as exhibits.[16] Previously, and among other things, public companies were required to file as exhibits each material contract (i) entered within the preceding two years, or (ii) which was to be performed in whole or in part at or after the filing of the disclosure document.[17] Following the rule changes, the two-year lookback applies only to newly reporting companies—this means that most public companies must file material contracts meeting only the second requirement above.[18]

And finally, the rule changes also made clear that certain types of personally identifiable information (“PII”) such as social security numbers, home addresses, etc., could be redacted outside of the CTR process.[19] Anecdotally, prior to this rule change, certain practitioners would file CTRs to redact these types of personally identifiable information, while other practitioners would redact the information outside of the CTR process on the basis that it was obviously confidential and that the likelihood of the SEC objecting would be very small.[20]

A. SEC’s Standard of Review of Redacted Information

The SEC has stated it “intend[s] to review registrant filings for compliance with the new rules” as part of its regular filing review process.[21] However, the SEC only selectively reviews filings,[22] which means that some (if not many) redacted exhibits will not undergo a formal review. During the rulemaking process related to the applicable Regulation S-K changes, the SEC admitted that “[o]ne potential cost of the amendments is that information may be redacted that would not otherwise be afforded confidential treatment by the [SEC] staff.”[23] However, the SEC felt that the impact of this potential shortcoming was mitigated by the fact that the SEC very rarely denies CTRs. In fact, from 2014 to 2018, the SEC formally denied only one CTR, and an additional 1% of CTRs were withdrawn by filers after the SEC determined the information in the exhibits was too material to redact.[24] But the SEC also noted that 11% of CTRs from those years were granted only after the SEC required the filer to reduce or modify the requested redactions.[25] Thus, while an overwhelming majority of CTRs were granted as-is, the rule changes will likely result in at least some redacted information that would have been revealed in a traditional CTR review remaining hidden from the public.

Nevertheless, it is important to emphasize that while the SEC’s review process has changed, the standard for what information actually qualifies for confidential treatment remains largely the same (aside from some changes in what verbiage should appear in the filings to mark the redactions and the clarification of the treatment of personally identifiable information).[26] Public companies therefore must still ensure they disclose all material information and redact no more information than necessary. If a public company does redact questionably protectable information and the SEC identifies it, the SEC may require that the company provide additional explanation or documentation regarding why the redacted information should qualify for confidential treatment, as well as unredacted copies of the relevant exhibits—essentially replicating the effort and cost of a traditional CTR.[27] If the explanation and documentation do not sufficiently justify the redactions, the SEC will require the company to publicly file an unredacted copy of the exhibit, which could result in negative publicity for the company.

B. Major Increase in Filing of Redacted Exhibits

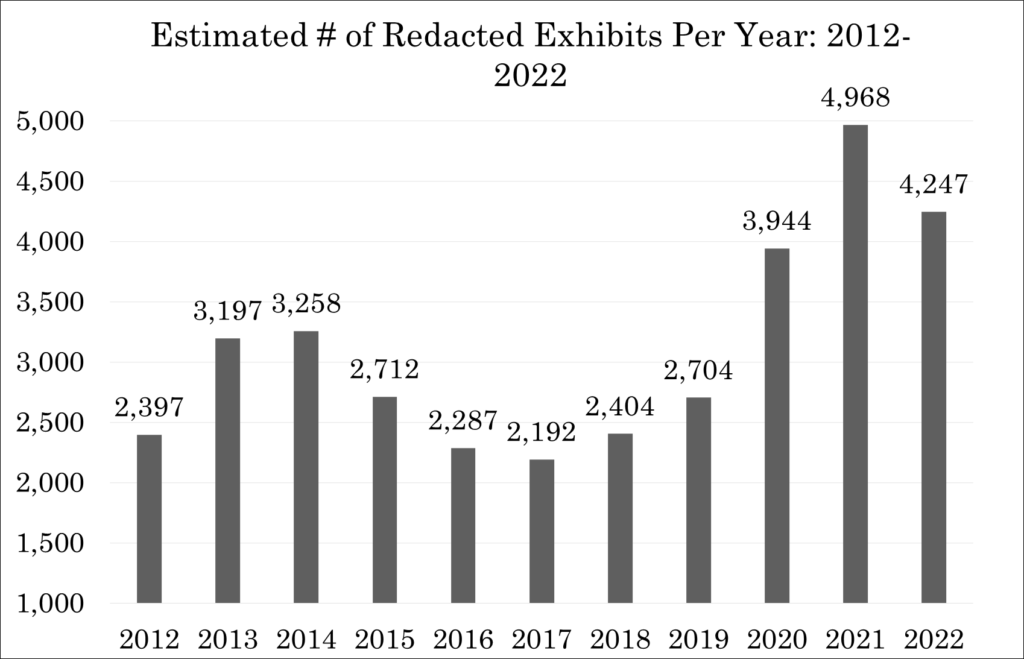

This Study utilized the Intelligize® database to search SEC filings and estimate the number of exhibits for which confidential treatment was sought from January 1 to December 31 of each year from 2012 through 2022. Searches were intended to uncover the total number of exhibits seeking confidential treatment during each calendar year, rather than the total number of CT Orders issued by the SEC each year, because the SEC often issues a single CT Order to grant confidential treatment of multiple exhibits for the same public company. Search terms reflected common verbiage used by public companies seeking confidential treatment in each respective year analyzed.[28] For example, since the 2019 rule changes, almost all redacted exhibits use the phrase “not material” in their prominent statements marking the redactions; this phrase was not commonly used prior to the rule changes. Search terms additionally accounted for some companies using outdated verbiage in their prominent statements marking the redactions, likely as a result of failing to recognize or comply with the rule changes.

As shown below in Figure 1, an estimated 4,247 redacted exhibits were filed with the SEC in 2022. This represents an increase of approximately 61% above the estimated average number of redacted exhibits filed in the years analyzed prior to the 2019 changes (an average of 2,635 redacted exhibits per year from 2012-2018). Note that while a vast majority of redacted exhibits are filed as an “Exhibit 10” pursuant to Item 601(b)(10) of Regulation S-K (including over 91% of redacted exhibits filed in 2018),[29] the results of this search include other types of redacted exhibits as well.

Figure 1

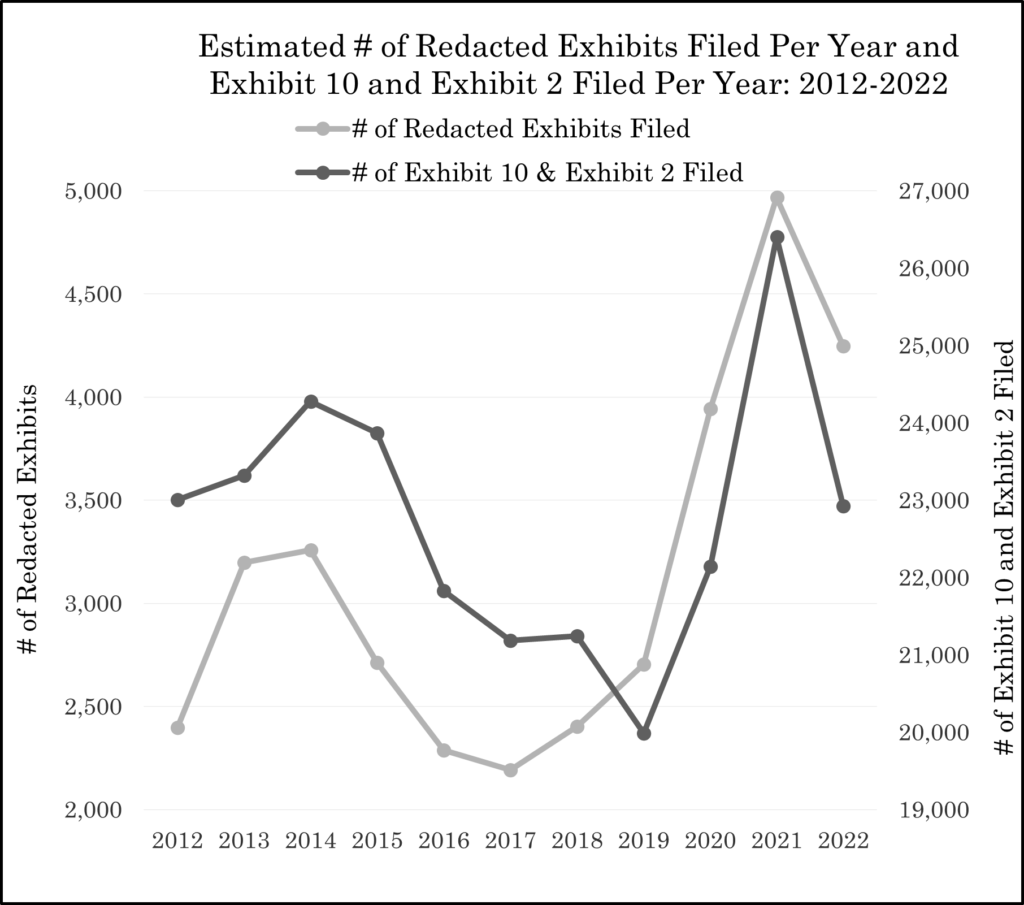

When considering these results in light of the SEC’s (i) removal of the two-year lookback period for filing material contracts—which presumably reduced the total number of material contracts required to be filed as exhibits following the rule change, and (ii) clarification of the treatment of personally identifiable information, the increase in redacted exhibits is even more significant than it first appears. In fact, as shown below in Figure 2, the estimated number of aggregate annual Exhibit 10 and Exhibit 2 filings—which constitute the overwhelming majority of redacted exhibits—shows a downward trajectory from 2012 to 2022, despite a temporary spike in Exhibit 10 and Exhibit 2 filings in 2021 and early 2022 that was likely the result of increased merger and acquisition activity in the midst of the COVID-19 pandemic, including a short boom in the use of Special Purpose Acquisition Company (“SPAC”) vehicles.[30]

Figure 2

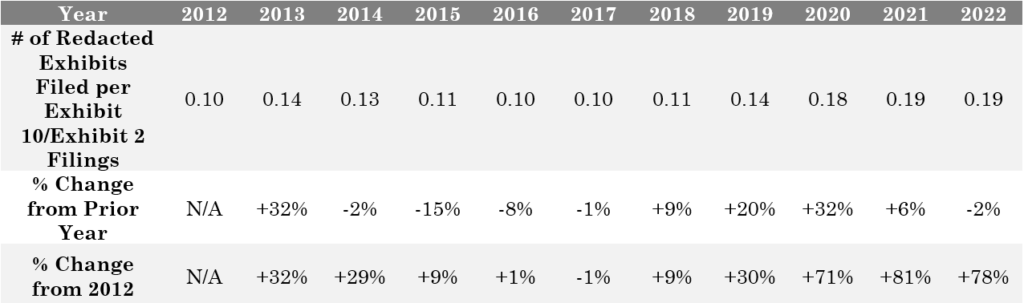

Despite the unique market factors present in 2021, the rate at which the number of redacted exhibits filed per year has increased following the 2019 rule changes has consistently—and significantly—outpaced the growth in the number of Exhibit 10 and Exhibit 2 filings. This suggests that in addition to filing more total redacted exhibits per year since the rule changes, public companies are also redacting information from a larger percentage of the material contract exhibits they file. The estimates below in Figure 3, which were calculated by dividing the total number of redacted exhibits by the total number of combined Exhibit 10 and Exhibit 2 filings per year, support this conclusion.

Figure 3

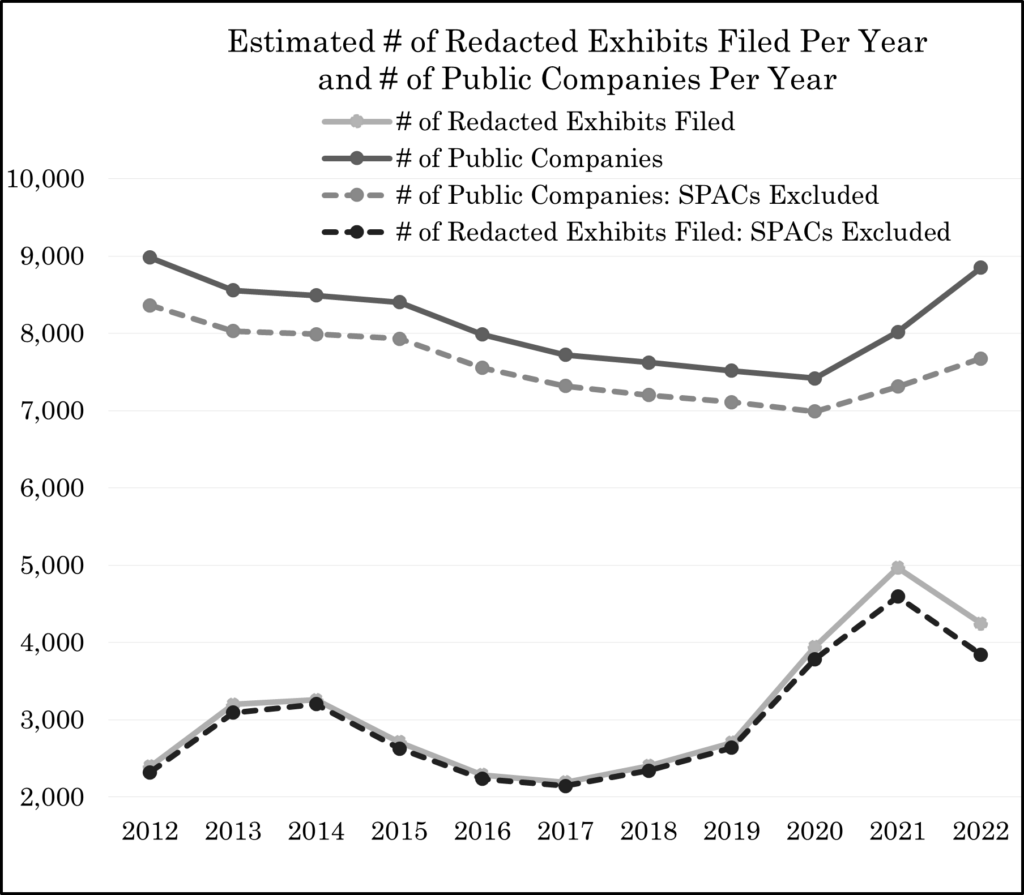

Moreover, the increase in redacted exhibits takes on added magnitude when considering the reduction of the number of public companies over the analyzed time period. To estimate the number of public companies per year, this Study again utilized the Intelligize® database to find the total number of required annual reports filed with the SEC—specifically forms 10-K, 10-KT, 1-K, and 20-F—in each year.[31]

As shown below in Figure 4, the total number of public companies gradually decreased from 2012 to 2020, but then jumped back up in 2021 and 2022. The recent rise is (at least in part) a likely result of the aforementioned SPAC boom. Because SPACs are public companies with no business operations, until they go through a de-SPAC process their filings do not typically contain the type of sensitive information that would warrant redactions in their SEC filings. Thus, to allow a clearer picture of how often public companies with actual business operations are redacting portions of their exhibits, Figure 4 also includes the estimated total number of public companies per year when SPACs are removed from the presentation. After removing SPACs, there is a much more consistent downward trend in the number of public companies over the studied period, from an estimated 8,361 in 2012 to an estimated 7,671 in 2022—a decrease of approximately 8%.[32]

Figure 4

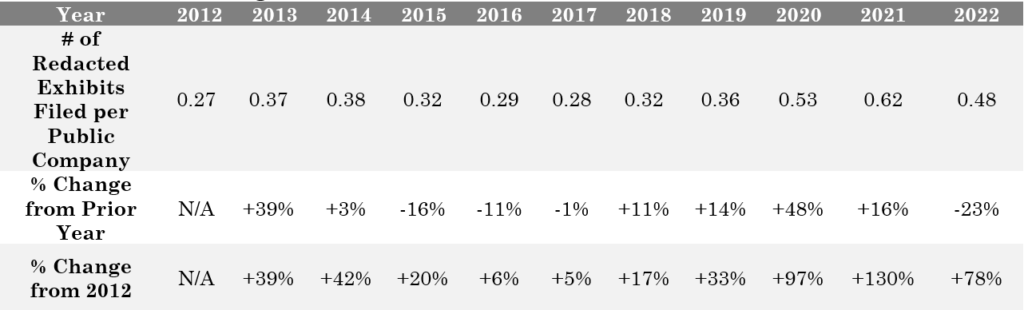

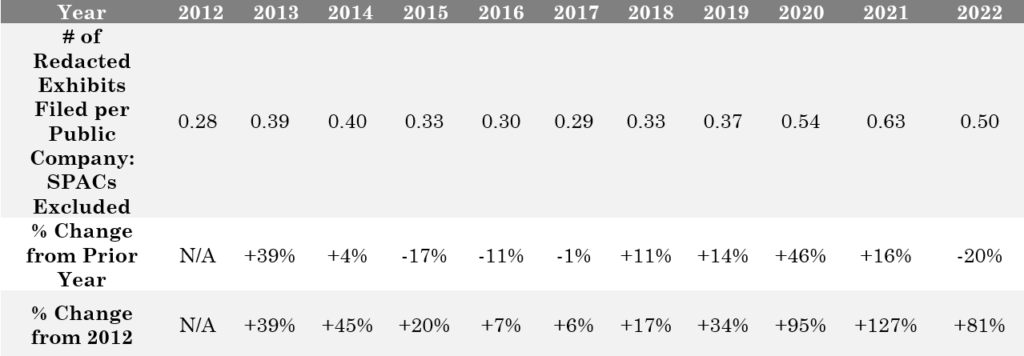

The intersection of the generally declining number of public companies and the increase in redacted exhibits following the 2019 rule changes suggests that public companies are now submitting a higher number of redacted exhibits per year. The estimates below in Figure 5A—calculated by dividing the total number of redacted exhibits by the total number of public companies in each respective year—support this inference, as the number of redacted exhibits filed per company has soared since the rule changes. As shown in Figure 5B, the growth in the number of redacted exhibits filed per company becomes slightly more pronounced when excluding SPACs from both data points.

Figure 5A

Figure 5B

Notably, the SPAC expansion also presumably played a major role in the influx of Exhibit 10 (and to a lesser extent, Exhibit 2) filings in 2021 and 2022. Again, when considering that SPAC exhibits are less likely to contain materially sensitive information because SPACs have no business operations prior to undergoing the de-SPACing process, the dramatic increase in the number of redacted exhibits filed per public company following the rule changes becomes all the more noteworthy.

An additional partial explanation of this phenomena may be the corresponding increase in the average size of public companies in recent years.[33] As public companies grow in size, it stands to reason that they may be party to more material contracts that warrant requesting confidential treatment.

More obviously, a significant portion of the increase in redacted exhibits may be attributable to companies seeking cost savings.[34] Public companies (especially smaller companies) that could not afford to or did not feel strongly about redacting certain immaterial information may have previously forgone the CTR process to avoid the expense of doing so.

But in addition to cost savings, it is no secret that public companies generally want to keep as much information private as they are legally allowed, and it appears that many are now testing the limits. In light of what appears to be a de-emphasis from the SEC on the administrative checks surrounding CTR redactions, public companies may be taking more aggressive stances on what information they redact in publicly filed exhibits.

C. Implications

The SEC’s modernization and simplification of its confidential treatment rules in 2019 made it drastically easier for public companies to redact information from their material contract exhibits. The results shown in this report reveal that public companies have already begun redacting information more often—and are thus keeping more sensitive (or purportedly sensitive) information away from their competitors—than before the rule changes. Overall, the rule changes appear to be a positive development for most public companies, as well as the SEC, primarily due to the associated cost savings and relieving administrative burden.

When looking at the impact of these changes on the market as a whole, the analysis of the increase in confidential treatment redactions is more mixed. The SEC’s loosened CTR application standards will undoubtedly increase the amount of redacted information that is actually material—and thus should have been disclosed to the public. The question is, to what degree? Measuring just how much material information is improperly redacted will be all but impossible to quantify, especially in light of the redactions obviously not being made public for study. But if the redactions are more extensive than expected, this could negatively impact competitive activity in a way the rule changes could not have intended. Conceivably, the SEC could further deter public companies from over-redacting by imposing serious penalties for clear violations of the new rules, but this has not yet occurred and does not seem likely.

In the end, assuming the SEC maintains a strong level of oversight, it seems unlikely that the increased volume of redacted exhibits will dramatically affect the investing public or the market in general. Public companies should remain diligent about disclosing all material information and complying with the updated rules to avoid unnecessary costs and compliance and enforcement risks.

———————————————————————————————————-

* Associate, Corporate & Securities, Troutman Pepper Hamilton Sanders LLP, Philadelphia, Pennsylvania; J.D., Villanova University Charles Widger School of Law; B.A., University of Michigan. The views expressed in this Study are only those of the Authors and do not reflect the views of Troutman Pepper Hamilton Sanders LLP or its clients. ↑

** Associate, Corporate & Securities, Troutman Pepper Hamilton Sanders LLP, Berwyn, Pennsylvania; J.D., Villanova University Charles Widger School of Law; B.A., Villanova University. The views expressed in this Study are only those of the Authors and do not reflect the views of Troutman Pepper Hamilton Sanders LLP or its clients. ↑

-

See Rules and Regulations for the Securities and Exchange Commission and Major Securities Law, U.S. Sec. & Exch. Comm’n, https://www.sec.gov/about/laws/secrulesregs (last visited Apr. 3, 2023). ↑

-

5 U.S.C. § 552 (2018). ↑

-

17 C.F.R. § 229.601(b)(10) (2022). ↑

-

17 C.F.R. § 230.406 (2022). ↑

-

17 C.F.R. § 240.24b-2 (2022). ↑

-

5 U.S.C. § 552(b)(4) (2018). See FAST Act Modernization and Simplification of Regulation S-K, 84 Fed. Reg. 12,674, 12,680 n.45 (Apr. 2, 2019). ↑

-

See generally, Securities and Exchange Commission Confidential Treatment Procedure Under Rule 83, U.S. Sec. & Exch. Comm’n, https://www.sec.gov/foia/conftreat (last visited Apr. 3, 2023). ↑

-

For an example of an order denying confidential treatment, see Order Denying Applications by New York Stock Exchange, LLC, Release No. 34-83760 (Aug 1, 2008), available at https://www.sec.gov/rules/other/2018/34-83760.pdf. ↑

-

Press Release, SEC Adopts Rules to Implement FAST Act Mandate to Modernize and Simplify Disclosure, U.S. Sec. & Exch. Comm’n (Mar. 20, 2019), https://www.sec.gov/news/press-release/2019-38. ↑

-

Fixing America’s Surface Transportation Act, Pub. L. No. 114-94, § 72002–72003, 129 Stat. 1312 (2015). ↑

-

FAST Act Modernization and Simplification of Regulation S-K, 84 Fed. Reg. at 12,680. ↑

-

139 S. Ct. 2356 (2019). ↑

-

Id. at 2366; Facilitating Capital Formation and Expanding Investment Opportunities by Improving Access to Capital in Private Markets, 86 Fed. Reg. 3496, 3530 (Jan. 14, 2021). ↑

-

Facilitating Capital Formation and Expanding Investment Opportunities by Improving Access to Capital in Private Markets, 86 Fed. Reg. at 3530. In addition, confidential treatment secured under the new rules is indefinite rather than having a fixed lifespan as it did in the past. See Div. Corp. Fin, U.S. Sec. & Exch. Comm’n, CF Disclosure Guidance: Topic No. 7, Confidential Treatment Applications Submitted Pursuant to Rules 406 and 24b-2 (Dec. 19, 2019, as amended March 9, 2021), https://www.sec.gov/corpfin/confidential-treatment-applications#options. This means that under the new rules, public companies no longer need to file requests to extend confidential treatment. However, public companies that secured confidential treatment of exhibits prior to the rule changes should confirm the SEC’s instructions for how to handle extensions going forward. Id. ↑

-

Search for Confidential Treatment Orders, U.S. Sec. & Exch. Comm’n, https://www.sec.gov/edgar/searchedgar/ctorders.htm (last visited December 31, 2022). ↑

-

FAST Act Modernization and Simplification of Regulation S-K, 84 Fed. Reg. at 12,692. ↑

-

Id. ↑

-

Id. ↑

-

Id. at 12,719. ↑

-

Id. at 12,691 (“As a matter of practice, the staff generally does not object where a registrant omits PII from exhibits without also submitting a confidential treatment request under Rule 406 or Rule 24b-2. To codify this current staff practice, the Commission proposed new Item 601(a)(6) to allow registrants to omit PII from their required Item 601 exhibits without submitting a confidential treatment request for the information.”). ↑

-

New Rules and Procedures for Exhibits Containing Immaterial, Competitively Harmful Information, U.S. Sec. & Exch. Comm’n (Apr. 1, 2019), https://www.sec.gov/corpfin/announcement/new-rules-and-procedures-exhibits-containing-immaterial. ↑

-

See Filing Review Process, U.S. Sec. & Exch. Comm’n, https://www.sec.gov/divisions/corpfin/cffilingreview.htm (last visited December 31, 2022). ↑

-

FAST Act Modernization and Simplification of Regulation S–K, 84 Fed. Reg. at 12,705–06. ↑

-

Id. ↑

-

Id. ↑

-

See 17 C.F.R. § 229.601(b)(10)(iv) (2022). ↑

-

See New Rules and Procedures for Exhibits Containing Immaterial, Competitively Harmful Information, supra note 23. ↑

-

For exhibits filed from 2012-2018 (prior to 2019 rule changes), the following search terms were used: ((omit* OR redact* OR omission*) w/40 (“filed separately” OR “separately filed”)) OR “confidential treatment has been requested”.

For exhibits filed from 2019-2022 (to account for the 2019 rule changes), the following search terms were used: (((omitted OR omits OR omission* OR redacted OR redacts OR redaction*) w/40 “not material”) OR (“has been excluded” w/20 “not material”)) OR (((omit* OR redact* OR omission*) w/40 (“filed separately” OR “separately filed”)) OR “confidential treatment has been requested”). ↑

-

FAST Act Modernization and Simplification of Regulation S-K, 84 Fed. Reg. at 12,682 n.69. ↑

-

See Christine Dobridge, Rebecca John & Berardino Palazzo, The Post-COVID Stock Listing Boom, Bd. Governors Fed. Rsrv. Sys.: FED Notes (June 17, 2022), https://www.federalreserve.gov/econres/notes/feds-notes/the-post-covid-stock-listing-boom-20220617.html#:~:text=Using%20data%20for%20the%20three,increase%20of%20about%2028%20percent; Kristin Broughton, M&A Likely to Remain Strong in 2022 as Covid-19 Looms Over Business Plans, Wall St. J. (Dec. 23, 2021 5:30 AM), https://www.wsj.com/articles/m-a-likely-to-remain-strong-in-2022-as-covid-19-looms-over-business-plans-11640255406. A SPAC is a type of blank check company “with no operations that offers securities for cash and places substantially all the offering proceeds into a trust or escrow account for future use in the acquisition of one or more private operating companies. Following its initial public offering . . . the SPAC will identify acquisition candidates and attempt to complete one or more business combination transactions after which the company will continue the operations of the acquired company or companies . . . as a public company.” Div. Corp. Fin, U.S. Sec. & Exch. Comm’n, CF Disclosure Guidance: Topic No. 11, Special Purpose Acquisition Companies (Dec. 22, 2020), https://www.sec.gov/corpfin/disclosure-special-purpose-acquisition-companies. ↑

-

The search excluded amended filings, such as 10-K/A, 10-KT/A, 1-K/A, and 20-F/A forms, to avoid duplication. ↑

-

The decline in the number of public companies extends all the way back to the 1990s. Heightened regulation of public companies, especially via the Sarbanes-Oxley Act of 2002, has incentivized companies to stay private or go private. See Jason M. Thomas, Where Have All the Public Companies Gone?, Wall St. J. (Nov. 16, 2017, 7:10 PM), https://www.wsj.com/articles/where-have-all-the-public-companies-gone-1510869125. The expansion of private equity and venture capital are other driving forces in this movement. See Spencer Israel, The Number Of Companies Publicly Traded In The US Is Shrinking—Or Is It?, MarketWatch (Oct. 30, 2020, 8:53 AM), https://www.marketwatch.com/story/the-number-of-companies-publicly-traded-in-the-us-is-shrinkingor-is-it-2020-10-30?mod=investing. ↑

-

Where Have All the Public Companies Gone?, Bloomberg (Apr. 9, 2018, 7:00 AM), https://www.bloomberg.com/opinion/articles/2018-04-09/where-have-all-the-u-s-public-companies-gone. ↑

-

FAST Act Modernization and Simplification of Regulation S-K, 84 Fed. Reg. at 12,705. ↑